News analysis

Corporate governance in 2023 – what’s on the agenda?

Corporate governance in 2023 looks uncertain; why wouldn’t it?

For now, businesses can’t escape that quagmire of instability, no matter the global problem keeping us there.

Twelve months ago, we were worried the Omicron variant (remember Omicron?) would send economies into another lockdown.

Now, we know we needn’t have worried, but that relief was short-lived anyway. War, supply chain crises, labour shortages, and volatile markets meant that for 2022 at least, boards and executives did not get a break.

What’s more, they shouldn’t expect a break soon either.

What’s next for governance in 2023

What have we learned, and why does it matter? Here are some main observations:

The road ahead is difficult

We face a market of peaks and troughs. Prices will fluctuate depending on availability, and if there’s one thing we have learned in the past year, it’s that ‘availability’ is a big word.

This is important because businesses still need to make themselves viable in this uncertain climate.

Boards and executives need to craft a sustainable strategy that answers every question investors, employees, and consumers ask. And they need to do it all while remaining financially healthy.

This won’t be easy, and sudden shocks in the market can deal significant blows. But this is the reality now.

Adaption is still key

The pandemic put the corporate world on a path it still can’t veer away from.

The last two years have been all about adaptation. The traditional skills at the governance level remain essential, but we need new ones too.

Change management, marketing, HR and cybersecurity are joining the likes of finance, audit risk and legal.

This is important because if a board or executive team is caught without these skills, things can go downhill fast. Imagine, for example, a cybersecurity crisis with no cybersecurity expertise at the top. It’s unlikely to go well. Corporate governance in 2023 needs skills diversity.

ESG is going nowhere

Environment, social, and governance principles have become a central pillar of investing in many parts of the world, mainly Europe, where attention is shifting to practice rather than goals.

This year, EU lawmakers agreed on a Corporate sustainability reporting directive (CSRD) to create far more robust reporting procedures.

It will “make more businesses accountable for their impact on society and will guide them towards an economy that benefits people and the environment,” according to Jozef Síkela, Czech Minister for Industry and Trade.

It’s important because, in the past, it was enough to commit to ESG principles to earn financial banking. Now, things are different.

Investors and lawmakers want accurate, standardised and accessible reports on firms’ ESG impact to demonstrate that they are as green, socially conscious, and well-governed as they say they are.

Adapting to these heightened standards is ultimately the responsibility of the board and senior management.

But the ESG debate is heating up

Is ESG the way of the future or nothing more than ‘woke capitalism’ as Florida Governor Ron DeSantis calls it?

While attention shifts to reporting in some parts of the world, in others, it shifts to whether ESG is worthwhile at all.

The criticism comes from the fiscal right, especially in the United States, where Republicans with power drive concerted efforts to discourage ESG investing, mainly in the name of fossil fuels and stakeholder return.

It matters because your business may be swept into this ESG debate depending on where it’s located.

Usually, this won’t be good news. Your firm is now caught in a loud battle of principles while trying to appeal to investors and consumers.

It’s one to keep an eye on.

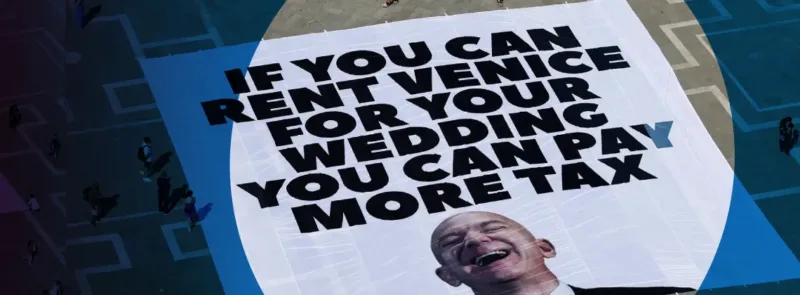

Governance is in the spotlight

You don’t need to ponder long to realise who we have to thank for this.

Elon Musk’s rough start as Twitter’s owner. Sam Bankman-Fried’s epic fall from grace with the collapse of his crypto firm FTX and Danske Bank’s record fine following years of money laundering investigations.

The scandal conveyor belt continues to deliver, and it doesn’t look like it’s shutting down soon.

These stories are important because lousy governance is at the heart of them all, and it means corporate governance in 2023 will take centre stage.

If you’re overseeing strategy, you want to see it work in practice. But these stories are beacons of the exact opposite. They feature mismanaged employee relations, upset stakeholders, financial crime, downright lies, and billions in losses.

Even if you scale the fallouts to the size and scope of your own company, you’ll still get an idea of what it’s like when governance goes horribly wrong.