News analysis

Corporate governance and elections: what to watch for as the world votes

Corporate governance and elections: how corporate leaders should apply their board director education as the world goes to the polls.

We are in full election mode in 2024. About 50 countries—representing around half of the world’s population—are expected to hold elections this year.

Indonesia went in February, and Mexico, South Africa, and India have just finished. The entire European Union will cast votes for bloc-wide representatives in June, and the United Kingdom will follow in July. Then there’s the small matter of the US Presidential Election in November, rounding off a truly remarkable year for democracy.

It’s crucial to recognise that this year’s elections will shape the leadership landscape for the rest of the decade and significantly impact corporate leaders—like any other group of professionals—who will be observing them with keen interest.

So, what should corporate governance professionals watch for in these elections?

Corporate governance and elections

It’s crucial to recognise that this year’s elections will shape the leadership landscape for the rest of the decade and significantly impact corporate leaders—like any other group of professionals—who will be observing them with keen interest.

So, what should corporate governance professionals watch for in these elections?

The intensity of regulations

It’s the defining question of this corporate generation: how many rules will come down from elected officials?

Before going any further, we should acknowledge that the volume of government regulations worldwide has generally increased, meaning more responsibility for directors and more robust penalties for getting it wrong.

That said, regulations are broad, and there will always be political tug-of-war over how much control should be placed on businesses.

Take the UK, for example. The current Conservative government promised to strengthen the country’s corporate reporting system, but in November 2023, it rolled back many of these proposals amid fears that Britain’s competitiveness would be harmed.

Corporate leaders should watch prominent politicians to see how they plan to strike this careful balance between integrity and competitiveness.

For many boards in this situation, it’s not about whether regulations will strengthen; it’s about the pace of that strengthening. A fiscally conservative government, less prone to market intervention, could easily slow the pace, perhaps prompting a rethink of strategy.

ESG

These elections will go to huge lengths to shape the future focus on ESG beyond any doubt. Here are two main reasons why:

Will the EU continue to drive?

The EU has seized on ESG over the last decade, if not in name, then in principle. Efforts to reach net zero, advance diversity initiatives, and enhance reporting requirements through CSRD have dominated the bloc’s political agenda.

The sheer scale of ESG-related initiatives means these trends will likely continue no matter what the next European Parliament looks like.

That said, the political climate in Europe is changing. Corporate leaders should watch to see how pushback against reporting requirements and net-zero transitions, as well as hot-topic issues like immigration, will translate to votes.

Will it mean more seats won by parties on the right or with other vested interests like protecting agriculture? If so, the pro-ESG agenda may suffer from more political pressure, hampering things like directive adoption and implementation, potentially meaning your corporate strategy might need to change or rewind in the short term.

It’s hard to know what to focus on.

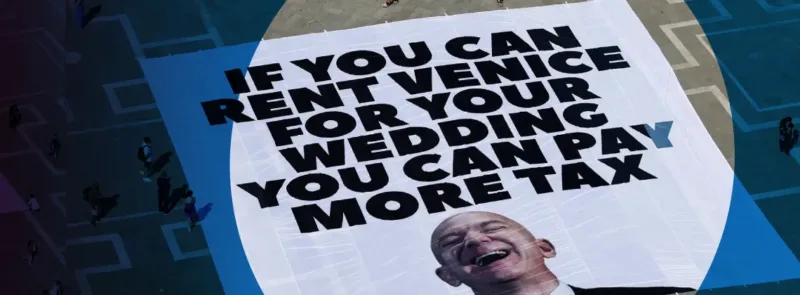

Make or break in the US

The United States has become an ESG battleground – a distant landscape from somewhere like the EU. Here, politicians fight over its very existence rather than its pace of implementation.

Critics of ESG in the US claim it harms investors’ returns and infringes on their free-market rights. In some states, laws have already been enacted to prevent ESG investing where possible.

The composition of the next US Congress and—indeed—the person in the White House will ultimately decide whether the anti-ESG movement will take hold on a national level.

If it does happen, US companies will be in a different landscape than they are now, and their corporate strategies must reflect that. Will your company continue to incorporate ESG? If yes, will you be public with it or approach it under a different name to avoid politics? These questions have been raised before in the US; we just need to wait and see what kind of political landscape is forming around them.

Ultimately

For corporate leaders, the strength and pace of regulations around governance and ESG are the things to watch.

The 2020s are proving highly polarised politically, and big changes in government will likely mean your strategies will see a change on the ground in some shape or form. Your job is to be clear on what that change will be, and how your organisation will manage and capitalise.

Remember, though, that regulations are just one part of the story. And your company still needs to stay in touch with shareholder, consumer and community moods. It’s a hard game, but a rewarding one if you get it right.

Insights on leadership

Want more insights like this? Sign up for our newsletter and receive weekly insights into the vibrant worlds of corporate governance and business leadership. Stay relevant. Keep informed.