Guides

Managing governance risk in supply chains

Managing governance risk in supply chains takes on extra importance when you consider that these supply chains are undergoing a complete revamp.

World crises such as the war in Ukraine, COVID-19 and the Suez Canal blockage incident have highlighted the vulnerabilities in supply chains. Climate change also represents a long-term threat to the stability of networks and has resulted in calls from stakeholders to create fairer and more sustainable supply chains.

For directors, the key is understanding “high-risk events” – anything that will likely cause serious harm to their company’s supply chain. If you’re on a board, you must be conscious of these events; they affect distribution, timetables and procurement.

Preventing such disruptions means improving resilience to uncertainty, and you can’t start doing that without assessing risk.

This guide will discuss the role of board members and how they play their part.

Managing governance risk in supply chains

Why is supply chain risk important?

Any kind of risk is important to a business, and boards are the key to managing it.

The goal isn’t to have a complete absence of risk, but your company can never let risk run out of control without proper safeguards.

Supply chain risk is significant to many businesses – especially those with intricate networks of partners stretching globally.

Runaway supply chain risk could end up costing organisations hundreds of millions of dollars. The last few years alone have seen this happen with multiple industries, including automotive, pharmaceuticals, and consumer goods.

The bottom line is that cross-border, supply-chain-based work is more common as globalisation increases. If that chain falls apart, you have a problem.

What kinds of organisations do these issues affect?

Obviously, some are affected by supply chain risk more than others.

If your company is a retailer, auto manufacturer, food producer, or resource provider, supply chain risk will likely be very high on your priority list.

What can organisations do about supply chain issues?

There are both known and unknown supply chain risks, and you need to consider both

Known risks are often quantifiable despite their likelihood, and typical examples include a supplier going bankrupt or exiting your market in some other way, even temporarily, due to issues like a cyber attack or government crackdowns.

You can manage known risks with a drill-down approach: documenting supply chain nodes and potential sub-risks involved. Use a risk register to help you with this. Any risks you identify can then be scored according to consistent standards, making it easier to identify focus areas.

Remember to keep these documents updated at all times as new issues develop.

Unknown risks, on the other hand, are those which are unpredictable. They include natural disasters or a global pandemic.

Be warned: unpredictable doesn’t mean you can’t prepare. The most risk-aware organisations will have contingency plans and good cultures in place to cover unknown risks. It ensures that, when something disruptive occurs, the company’s response speed can keep its success afloat.

How do I score supply chain risk?

You balance probability and the potential impact on your organisation and quantify it in a way that makes sense. The result is your risk score.

Low-risk events would only have a limited effect on the supply chain, so the level of planning you need is lower. Medium-risk events call for closer control since they have a high enough chance of occurring. High-risk events require immediate attention. Most companies and investors will not entertain high-risk situations and look for quick ways to control the risk.

Assessing your collaboration with your supplier network

If you’re trying to assess the level of risk within your supply chain, look at each of your suppliers and consider the following:

- Are geopolitical tensions affecting the supplier’s ability to work with you?

- Are local market fluctuations that might affect the supplier’s ability to work with you?

- Does your supplier follow your organisation’s social standards – for example, in employee welfare or community engagement?

- Is a specific supplier the only one of its kind you can depend on? If not, might it be worth considering a second if the first runs into trouble?

How can good governance help?

While directors may feel distant from suppliers in the chain of command, the board still must play an active role in supply chain management.

Every board should have time and processes for reviewing external partnerships. However, they come about and whatever they’re in place to achieve.

These reviews will encourage directors to think about their company’s financial model, what works, what doesn’t, and the presence of dangers and opportunities. All of these feed into risk assessment.

The role of communication

Supply chains are sometimes vast networks; without adequate communication, you won’t have a realistic view of what’s happening within.

This requires a culture of transparency, where any supplier can feel able to pass on bad and good news.

Everyone, from directors to supply chain employees, should be clear on their responsibilities and set a tone of accountability that reduces risk and increases efficiency.

The role of technology and data

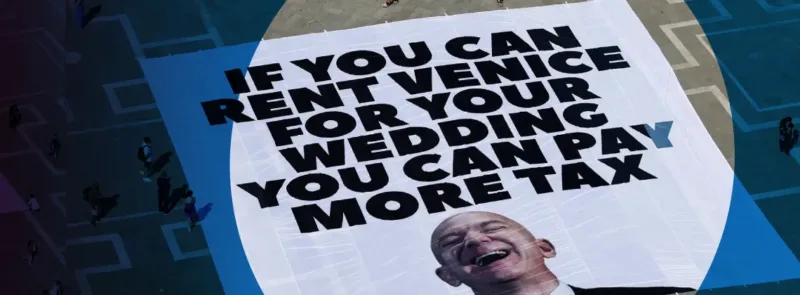

Diversity at the top of corporate America is a big topic. California and Illinois have laws on board diversity for companies headquartered in their states.

Advocates for people with disabilities had pushed both Nasdaq and the SEC to include disability in the proposal but were unsuccessful, so we can expect to see a lot of shareholders and investors demanding that big firms make a genuine commitment to diversity, especially at the board level.

The Nasdaq proposal is significant and has the potential to drive real change in the top floors of corporate America.

What is the “great supply chain reset”?

It’s an evolving trend documented by several experts and major publications.

The trend involves many companies completely re-thinking their supply chain strategy, primarily motivated by the turbulent economy of the last five years – between the pandemic, inflation and geopolitical crises like Ukraine, Israel-Gaza, or tensions between the US/Europe and Russia/China.

Now, companies are aiming for more balanced, multidimensional supply chains to reduce risk and increase longevity.

Often, but not always, this also involves a transition to more sustainable practices, with greater emphasis on ESG (environment, social and governance) principles.

Developing your own company’s response to this should involve a thorough investigation of what modern supply chains are capable of and where they can work for you in terms of risk and opportunity.

The last thing you want is for your supply chain to burden you with increased costs and unexpected crises, when alternative options could have been better.

All of this requires careful consideration from the board since different types of products may have other financial and reputational implications. But one thing is certain: supply chains of tomorrow will be less linear and more complex, and sourcing decisions will be based on more than simply cost.